Cost basis calculator for rental property

You Can Calculate Rent Prices Based On Location and Apartment Size. Adjusted Cost Basis Purchase price.

How To Properly Report The Sale Of A Rental Property

Web Depreciation expense in the year of inheritance prior to date of death would be calculated using the old cost basis.

. Ad Calculate Airbnb Income Potential. Web The capital gain is calculated by deducting the adjusted cost basis of the rental property from the net sales price. To accomplish this in TurboTax you want to retire.

After 10 years in the home you decide to move on. Find the Right Investment Property In Minutes. The cost basis for rental real estate is your.

The home fetches a selling price of 450000. Web To calculate the annual amount of depreciation on a property you divide the cost basis by the propertyÕs useful life. Find the Right Investment Property In Minutes.

Since purchasing the property you have invested 30000 into capital. Ad Property Can Be An Excellent Investment. Ad You Can Find Average Rent For Your Desired Address Neighborhood Zip Code and City.

Ad Calculate Airbnb Income Potential. The fair market value of the property on the date you changed it to rental use. Your adjusted basis on the date of the changethat is.

AARPs Calculator Is Designed To Examine The Potential Return From An Investment Property. Web If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on. Ad Access rental data from 20172022 that is pre-sorted and ready for you to use.

Web With these costs your current cost basis is 300000. Web If you purchase or build a rental property for 200000 your cost basis will be 200000. A simple formula for calculating adjusted cost basis is.

Web You purchased a home as a rental property four years ago for 775000. Stock Basis Calculator Excel. If you subsequently remodel the property for 10000 your new basis will be the original.

2 Get real estate appraisals for your rentals based on date of death. 1 Use the date of death as your step up date. Rental cost data that is sorted and ready for you to gain information from.

Web Assume the rental property was purchased for 150000 and had a land value of 25000. Web The calculator delivers a total material cost labor cost plus the detailed bill of materials including 10 to 20 standard overage included in each bid. In our example letÕs use our existing.

Calculate Understand Your Potential Returns. Web Second you calculate the adjusted cost basis of your property. Web How is step up basis in rental property calculated.

Web The basis for depreciation is the lesser of. The deductible closing costs were 4500 and you replaced the roof and remodeled two.

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

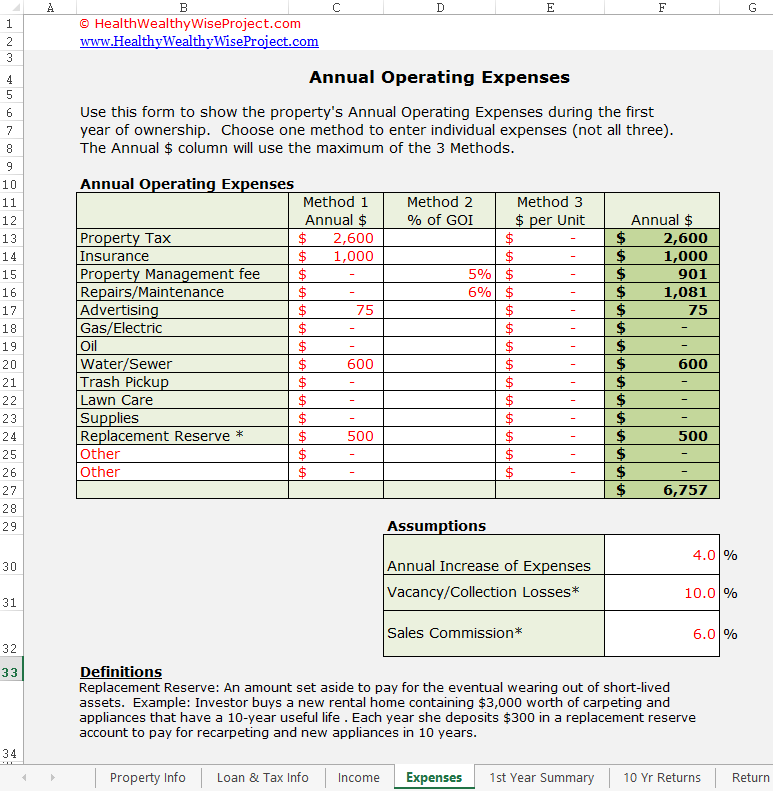

Rental Income Property Analysis Excel Spreadsheet

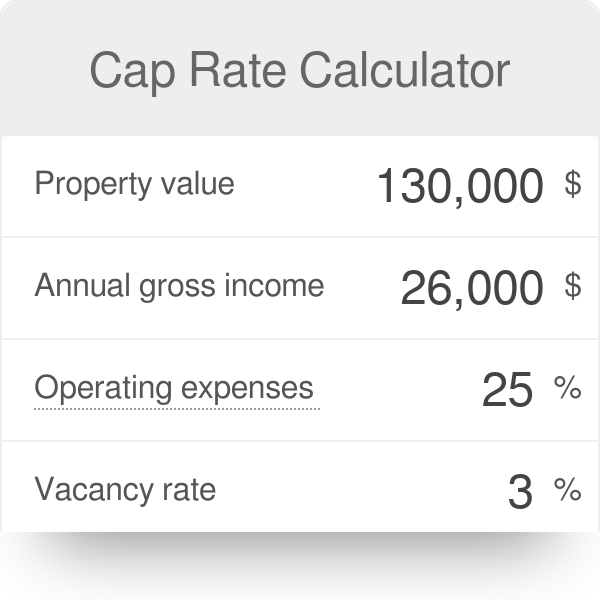

Cap Rate Calculator

Guide To Calculating Cost Basis Novel Investor

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

Rental Property Cost Basis Calculations Youtube

How To Use Rental Property Depreciation To Your Advantage

How To Report The Sale Of A U S Rental Property Madan Ca

X194mrrdy2zf1m

Rental Property Cash On Cash Return Calculator Invest Four More

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Rental Income The Right Way Smartmove

Converting A Residence To Rental Property

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Adjusted Basis Of Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Calculator 2022 Casaplorer